Revenue Appellate Tribunal exists for every taxpayer

Taxes are the main source of revenue to provide essential public services in a

country. Tax administration system needs to ensure an appropriate distribution of

the tax burden among taxpayers and promote economic growth in order to be able

to collect all types of taxes payable under law without any gap. In addition, the

appeal system which is transparent and fair is required to exist for any taxpayer to

file their appeal to; when he is dissatisfied with any assessment made by assessing

officers. Hence, the consecutive governments of Myanmar have set up Revenue

Appellate Tribunals and strived to achieve justice throughout history.

In pursuance of section 5 A of the Burma Income - Tax Act (1922), Income

Tax Appellate Tribunal consisting of 3 members including the Chairperson has been

formed and income-tax appeal cases had been heard and judgments were passed.

Under the Revolutionary Council of the Union of Burma, the Revenue Appellate

Tribunal comprising of four members including the Chairperson has been formed,

starting from 1 st October 1972, and cases on appeal, revision, review and reference

to the Supreme Court relating to Customs duty, excise duty, stamp duty, hotel and

restaurant tax, entertainment tax, other than income-tax appeal cases had been

heard and judgments were passed. Thenceforth, the Income-Tax Appellate Tribunal

was renamed and stipulated as “Revenue Appellate Tribunal.”

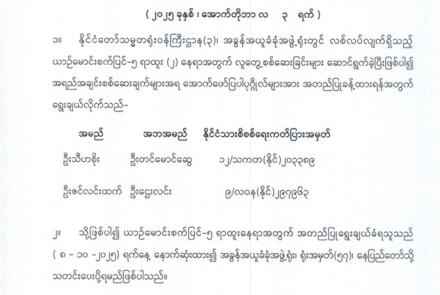

Formation of the Tribunal

Under sub-section (d) of section 10 of the Profit Tax Law (1976), by

Notification No. 12 dated 11-12-1976 issued by the council of ministers of the

Socialist Republic of the Union of Burma, under Notification No. (6/89) dated 28-7-

1989 issued by the Cabinet of the Union of Myanmar, under Notification No.

(54/2017) dated 31-5-2017 issued by the Cabinet of the Republic of the Union of

Myanmar, the Revenue Appellate Tribunal has been set up and assigned to hear

cases and make judgment.

Tax reform activities are being undertaken by the government to be able to

collect taxes without any gap. In addition, the Revenue Appellate Tribunal Law was

enacted on 1st October 2018 by the Pyidaungsu Hluttaw Law No. 23 to ensure taxes

are levied on every taxpayer with justice and fairness and every taxpayer gets the

right of appeal and the right of defense by the law.

By Notification No.(341/2019) dated 27-9-2019 issued by Ministry of Union

Government Office, the Revenue Appellate Tribunal Rules was promulgated to

implement the provisions of the Revenue Appellate Tribunal Law. By Notification

Dr. Ei Hlaing Thet Zar

Translated by: Maythu Htay

2

No.(9/2021) dated 4-5-2021 issued by Ministry of Union Government Office, the

aforementioned Revenue Appellate Tribunal Rules was amended.

An independent organization

Revenue Appellate Tribunal is set up as an independent organization in

accordance with the provisions of Revenue Appellate Tribunal Law and Rules. In

exercise of Quasi-Judicial Power and Discretionary Power conferred by Revenue

Appellate Tribunal Law, cases on appeal, revision, review and reference with

respect to all types of taxes collected by respective departments and organizations

under the Union government have been heard.

A strategic plan was adopted by the Revenue Appellate Tribunal in order to

provide efficient tax administration through a transparent and fair tax appeal system

and obtain Myanmar citizens’ and taxpayers’ trust. To meet the vision and mission,

four tactical plans have been drawn up and implemented for 2020-2021 and 2021-

2022 fiscal years. Based upon strengths and weaknesses learnt, tactical plans for

2022-2023 and 2023-2024 fiscal years have also been drawn up and implemented.

Furthermore, strategic plans, tactical plans and action plans to be implemented from

2023-2024 fiscal year to 2024-2025 fiscal year have been drawn up.

The Revenue Appellate Tribunal and the Revenue Appellate Tribunal Office

has continuously strived to act as a supporting government organization for the

Cabinet by providing justice, right of defense and right of appeal to Myanmar citizens

and taxpayers in line with Sustainable Development Goals- SDGs and Myanmar

Sustainable Development Plan – MSDP.

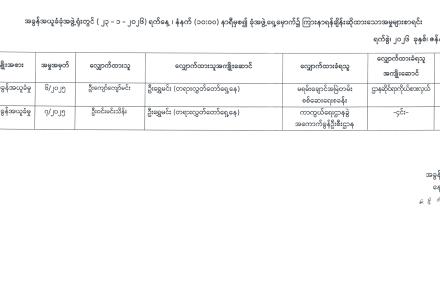

In 2021, State Administration Council formed the Revenue Appellate Tribunal

comprising of the Chairman and 6 members. Cases are being heard and adjudicated

by the Tribunal in accord with the prescribed Revenue Appellate Tribunal law. Cases

that may be filed to the Tribunal are as follows.

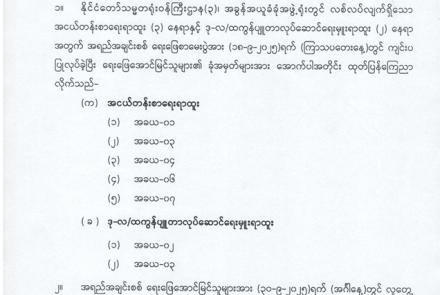

Appeal

Appeal means an appeal filed to the Tribunal against an assessment order passed

by any department responsible for collecting internal revenue or by the Customs

department or against a final decision on an assessment order made by any

government department or organization assigned by the Union Government through

a notification from time to time. Appeal may be filed to the Revenue Appellate

Tribunal using the form prescribed by the Tribunal within 90 days from the date of

the receipt of the said order. Even though filing has not been made during limitation

of period, the appeal may be accepted if there is sufficient cause.

Revision

Revision means a case re-filed by an aggrieved person to the Tribunal, to revise,

with respect to issues of fact, against the order passed by the Tribunal. Revision

3

may be filed to the Tribunal using the form prescribed by the Tribunal within 60 days

from the date of the receipt of the decision of the Tribunal.

Review

Review means a case re-filed to the Tribunal by any person receiving the decision of

the Tribunal, to review the decision. The power is conferred upon the Revenue

Appellate Tribunal to review its decision in accordance with the law. Review may be

filed to the Revenue Appellate Tribunal using the form prescribed by the Tribunal

within 90 days from the date of the receipt of the decision of the Tribunal. Review

may be filed to the Tribunal where there is reasonable ground in accordance with

Rule 1, Order 47 of the Code of Civil Procedure.

Reference

Reference means a case referred to the Supreme Court of the Union regarding

issues of law, after hearing it by the full bench. When the applicant or respondent

applies for a reference or any issue arises to refer the case to the Supreme Court of

the Union, the full bench shall decide whether it should be referred. Reference may

be filed to the Tribunal using the form prescribed by the Tribunal within 60 days from

the date of the receipt of the judgment of the Tribunal.

A person who wishes to file a case to the Tribunal may apply to the registrar

with the prescribed form personally or through a legal representative or legal

practitioner. During the wave of the Covid-19 pandemic, it is allowed to submit a

case to the Tribunal by means of addressing to the registrar by post or express

delivery service. Thanks to such kind of alleviation initiated by the government,

Myanmar citizens and taxpayers do not miss the chance of filing any case to the

Tribunal during limitation of period.

Filing a case to the Tribunal

A case may be filed to the Tribunal using the prescribed form and this form

can be obtained from the Revenue Appellate Tribunal Rules and the registrar of the

Tribunal. When filing a case, an applicant shall pay Court fees which is levied in

accord with the regulations of Court Fees Act.

When applying for appeal, revision and review to the Tribunal, along with

application, one original and six copies of documentary evidences are required to

submit. When applying for revision, along with application, one original and twelve

copies of documentary evidences are required to submit. Civil Power of attorney

which bears Court-fees stamp upon it and a certified certificate of attorney are

required to be submitted if a person applies through a legal practitioner. Power of

attorney authorizing in accordance with the relevant law is required to be submitted if

a person applies through a representative.

In case an applicant is a company or an organization, it shall be filed by the

name of the company or organization. Where an applicant is a person participating

4

in the company or organization, it shall include power of attorney which bears Court-

fees stamp upon it by the resolution of board of directors. If any person who is not

participating in the company acts as an agent, it shall include Special (or) General

Power of Attorney in accord with the provisions of Revenue Appellate Tribunal Rule

39.

An applicant shall submit certified copy of tax-related final decision or

conclusive judgment of relevant departments or organizations along with the

application.

In conformity with the Covid-19 prevention regulations issued by Ministry of

Health, cases were heard and made judgments via video conferencing system

during the controlling period of the Covid-19. At present, not only cases are being

heard via video conferencing system but also hearing cases in public are being

carried out by the law in complying with the Covid-19 regulations.

The Revenue Appellate Tribunal notifies that in hearing of cases, where an

agent, not lower than Staff Officer, who is appointed by any relevant government

departments or organizations, on its behalf, may plead and address the Court.

Nonetheless, any other persons, except authorized agents and legal practitioner, are

prohibited from addressing the Court.

Notwithstanding anything in any existing laws, revenue appeals shall be filed

and heard only under Revenue Appellate Tribunal Law, which is promulgated in

section 41 of the Revenue Appellate Tribunal Law. Thus, an appeal against orders

or decisions of all kinds of revenue (taxes, fees, licence fees, permit fees or fines),

against all forms of revenue in schedule (1) of Union Taxation Law and customs

duties shall be submitted to the Revenue Appellate Tribunal in line with the rules.

Cases submitted to the Tribunal have been heard and adjudicated independently in

accordance with the law and for cases heard by the Tribunal, the decision on issues

of fact is final.

Uploading “Revenue Appellate Tribunal’s page”

Information and Communications Technology has enabled the Revenue

Appellate Tribunal to announce its functions in public. Moreover, the Revenue

Appellate Tribunal has proudly uploaded its Facebook page named “Revenue

Appellate Tribunal” and posted its functions and activities there. The Revenue

Appellate Tribunal has continuously made efforts to upload the judgments passed by

the Tribunal on its own website for the sake of parties and the public. Currently, it

has successfully uploaded a page on Myanmar National Portal independently. Any

taxpayer are welcome to visit this page to get information about Revenue Appellate

Tribunal Law, Revenue Appellate Tribunal Rules, notifications issued by the Tribunal

from time to time, directives and the prescribed forms.

5

The Revenue Appellate Tribunal and the Revenue Appellate Tribunal Office

has attempted to record cases filed to the Tribunal effectively through case

management system for the purpose of sustainability.

The Revenue Appellate Tribunal has used SMS on the mobile phone to ask

citizens and taxpayers who seek services at the Tribunal via Short Code No “1111”

for feedback as a way to implement Public Feedback Programme - PFP undertaken

by the Anti-Corruption Commission. The Tribunal has sought citizens’ responses

and suggestions to the Tribunal with the aim of fulfilling the requirements.

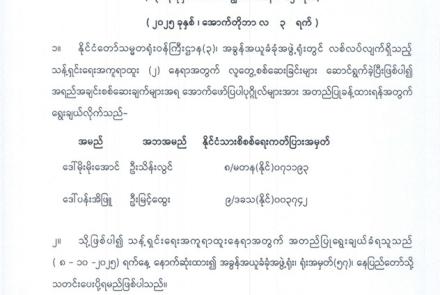

Inaugurating a new office of the Revenue Appellate Tribunal

The Revenue Appellate Tribunal holds its sitting in Nay Pyi Taw and

previously it was located at Office No. (46), Internal Revenue Department. Then,

with budget allocated by the State, a new building of the Revenue Appellate Tribunal

was built on 6.05 acres of land in north of Thirimantine Road, Ottarathiri Township,

which is adjacent to Office No.(46). As of 29 th October, 2021, the Revenue Appellate

Tribunal and its staff has moved to a new building and started carrying out its

functions. A new office of the Revenue Appellate Tribunal was inaugurated by State

Administration Council member, Union Minister for Ministry of Union Government

Office, Chairman of National Solidarity and Peace Negotiation Committee,

Lieutenant General Yar Pyae, on 23 rd December, 2022.

In harmony with the motto “For Trust, Justice and Fairness, the Revenue

Appellate Tribunal exists,” the Tribunal has made its earnest efforts to prevent

revenue loss and provide the best service to Myanmar citizens and taxpayers. On

the other hand, the Revenue Appellate Tribunal has strived to ensure justice,

equality, the right of defense and the right of appeal for Myanmar citizens and

taxpayers. It is proudly stated that the Revenue Appellate Tribunal and the Revenue

Appellate Tribunal Office is continuously pursuing life-long learning, conducting

knowledge-sharing programs led by scholars and technicians from respective fields

and taking measures to achieve better job performance.

References

- History of Revenue Appellate Tribunal

- The Revenue Appellate Tribunal Law and Rules

- Directives of the Revenue Appellate Tribunal

- U Mya and U Kyaw Aye Civil Procedure Code

- Strategies, tactics and action plans of the Revenue Appellate Tribunal

းပါး။

- Log in to post comments